How Resilient Are Apartment Cap Rates in a Crisis?

-

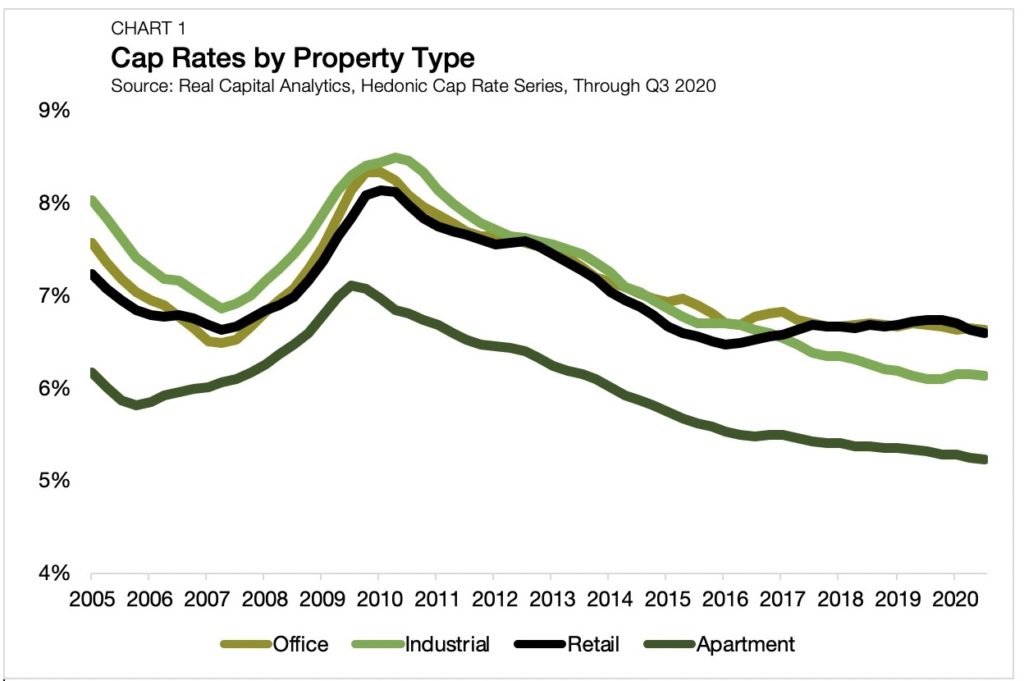

Apartment cap rates averaged 5.23% in the third quarter of 2020, according to Real Capital Analytics.

- Multifamily, retail, industrial and office cap rates have all fallen since the beginning of 2020.

- During the great financial crisis, apartment cap rates widened the least when compared to other property types.

Multifamily: Historically the Least Risky

While all commercial real estate property types operate within their unique supply and demand conditions, there is a sense that, more than other sectors, multifamily beats to its own drum. In terms of underlying demand stability, availability of financing, and investor accessibility, a laundry list of factors make multifamily the most idiosyncratic, and historically the least risky property type. Using Real Capital Analytics hedonic cap rates data, we explore the relative resilience of the multifamily asset class over the past two decades.

Cap Rates Across Property Types

Cap rates are both a measure of investor return as well as perceived risk. The yield structure of a cap rate reflects both the risk-free rate of interest, which is best measured by the 10-year Treasury, and a premium meant to compensate for additional risks.

In recent history, multifamily assets have had the lowest cap rates of any major CRE asset type, and by a healthy margin. Through the third quarter of 2020, average multifamily cap rates stood at 5.23% (Chart 1).

The property type with the next lowest average cap rates is industrial, measuring 91 bps higher at 6.14%. Dating back to 2001, the spread between multifamily and the next lowest CRE cap rate at any given point in time has averaged 92 bps and never sank below 41 bps.

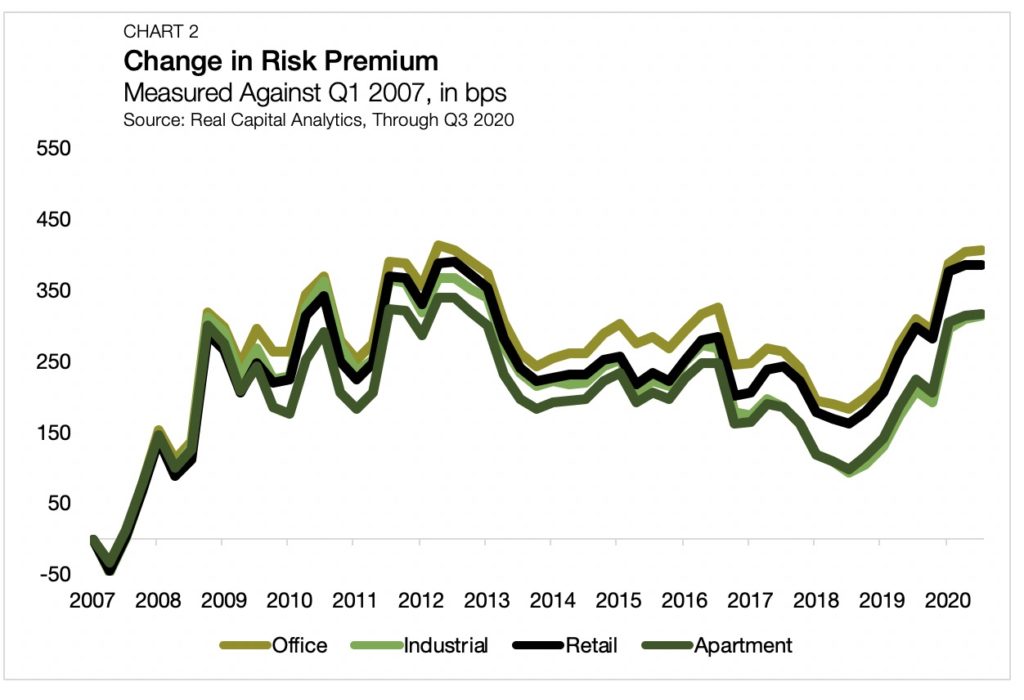

During the great financial crisis, cap rates rose across the board. Moreover, the magnitude of cap rates widening was similar for all property types. Compared to the beginning of 2007, risk premiums for retail, industrial, office and apartment all rose between 290 and 320 bps during the following two years.

The Great Financial Crisis and Today’s Recession

Following the turmoil, investors realized and priced-in the fact that the long-term impacts of the great financial crisis and e-commerce would differ across property types. Simple logic prevailed. A consensus that retail assets anchored by a Borders, Sears or Sports Authority might have a more difficult path ahead than a well-located multifamily asset led to a re-stratification of risk pricing.

By early 2010, the apartment sector’s risk premium fell to just 177 bps above its 2007 benchmark, preceding the great financial crisis. At the same time, retail, industrial and office all had risk premiums between 226 and 264 bps above their pre-crisis levels (Chart 2).

The U.S. economy and the world of commercial real estate are once again in the midst of another crisis. Uncertainty and a lack of real-time performance data led to forecasts in March and April that ranged from overly optimistic to prepping for doomsday. Now, in hindsight, it appears that cap rates have not materially widened as a result of the crisis — at least not yet.

Apartment Cap Rate Resiliency

Nonetheless, the apartment sector’s track record of absorbing crisis-level shocks is second to none. While there remains the potential for speed bumps in the months and years to come, the apartment sector’s balance of supportive liquidity and end-user demand keeps it as one of the property types to most likely attenuate the risks ahead.

Check out Arbor Realty Trust’s Chatter blog to stay current on the latest multifamily news and information. Contact Arbor today to learn more about our multifamily products to further your investment goals.